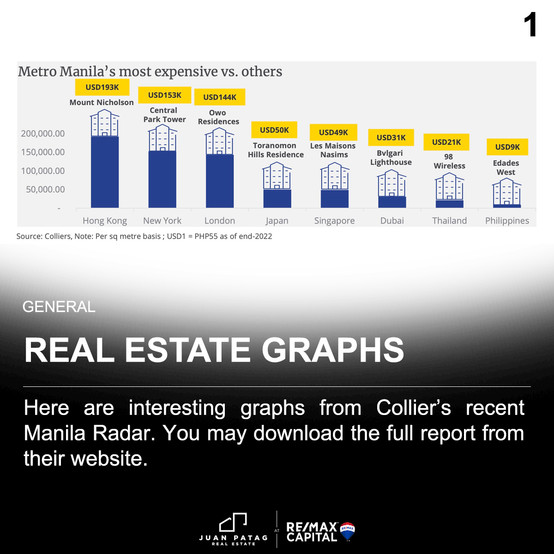

Real Estate Graphs

- JPRE

- Mar 30, 2023

- 1 min read

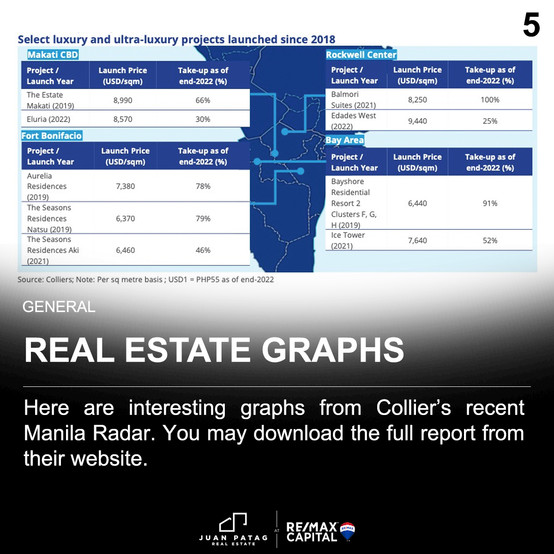

Here are interesting graphs from Colliers' recent Manila Radar Report. You may download the full report from their website.

JPRE Comments:

Slide 1: One reason PH real estate is still cheap compared to other countries is: the limited financial capacity of local buyers. According to CEIC, Thailand's per capita income in 2022 is US$7,496, while the Philippines' is US$3,623.

Can we expect prices to be as high as the top countries in the graph? Possibly, but this should be supported by a significant increase in the purchasing power of the local market–which could take decades.

Slides 2 and 3: The luxury market remains the most attractive among the bunch since this market is the least affected by the pandemic/high-interest rate regime.

Slide 4: Developers have resorted to joint ventures as the scarcity of developable land worsens in the metro. One provides the land and the other their marketing/sales expertise.

Slide 5: The market continues testing Php500-600K/sqm prices. The Developer for Aurelia introduced a total of 6.5% increase between July 2022 and January 2023, bringing the current price to ~Php512K/sqm.

Slide 6: Notice the slope of 2012-2018 and compare it to the slope of 2021-2024F; it flattened. This means Colliers' forecast is for capital appreciation to be slower than what we saw in 2012-2018.

_edited_.png)